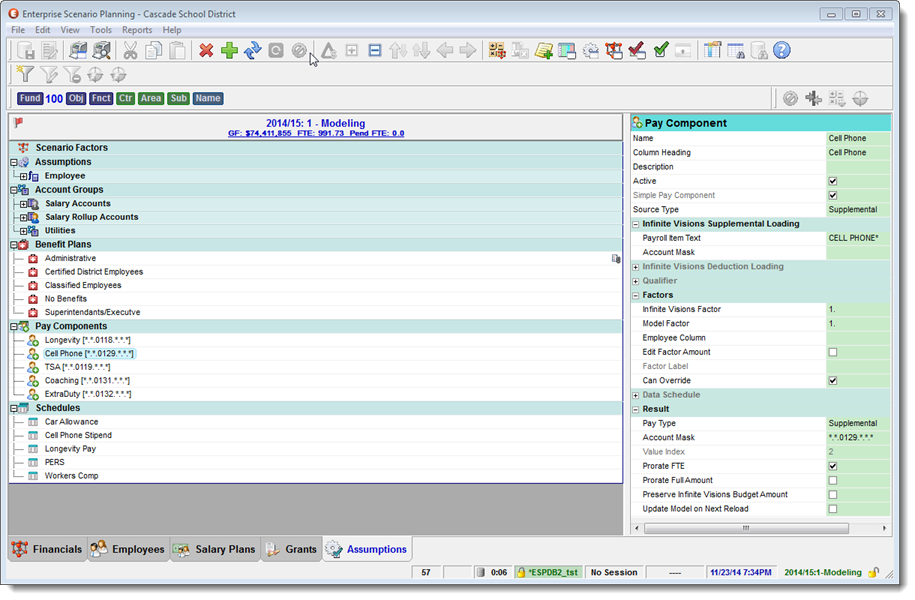

Pay Components

ESP Pay Components provide a flexible and powerful means of calculating supplemental costs based on individual employee and fixed factors. Pay Components can uses to manage supplemental payroll costs such as :

•Extra Duty Pay •Longevity Pay •Coaching •Employee Assistance Programs |

•Tax Sheltered Annuities •Cell Phone Stipend •Car Allowance •Additional Insurance |

When a Pay Component is coupled with an ESP Data Schedule, the Factor Amount of a Pay Component can be found by looking up values based on Employee Funding information like Salary Plan Grade or Years of Service. ESP currently support up to 20 unique Pay Components calculations.

Pay Component Pay Types

There are three primary Pay Types available for Pay Components which control where the calculated amount of a component is included in the Employee Funding:

1.Salary - The calculated amount is included in the Total Salary along with any Annual Rate amount.

2.Supplemental - The calculated amount is included in the Total Pay along with any Total Salary.

3.Benefits - The calculated amount is included in the Total Benefits along with the Benefits amount.

Pay Component Source Loading

Supplemental pay details are loaded directly from your payroll system just as the details of employee salaries are and can be configured to load from supplemental pay or employer paid deductions depending on how your payroll system has been integrated with ESP.

1.Supplemental Pay Items - Details are loaded supplemental pay items based on specific search text, Pay Type list or Budget Element String Mask.

2.Deduction - Details are loaded from Employer Paid deductions bases on Deduction Category, Deduction Type, or individual Deduction Id.

Pay Component Calculations

Employee Pay Component Columns

Each Employee Funding maintains a separate set values for each configured Pay Component which are used during Employee Calculations:

Pay Component Column |

Description |

|---|---|

Enable |

|

Factor |

The initial amount loaded from the payroll system, calculated, or entered by the user. When a Pay Component is configured to Prorate By FTE, all Employee Fundings for an Employee will use the same Factor Amount. |

Percent |

The percentage used to calculate the Base Amount |

Amount |

The final Amount of the Pay Component calculated |

Calculating Pay Component Percent

The Pay Component Percent determines how much of the Factor amount will be used in calculating the Pay Component Amount. The table below defines the sequence and conditions used that is to determine the final Percent value.

Sequence |

Enabled |

Keep |

Prorate FTE |

Prorate Full Amount |

Reset Percent |

|

|

|

Value |

|---|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

Supplemental Pay Components

When calculating Pay Components for Employees with multiple Fundings, each individual Pay Component in each Employee Funding is checked to see if there are any Supplemental Employee Fundings with that Pay Component Enabled. If there is, the Pay Component will be calculate as a Supplemental Pay Component for that Employee. Because Supplemental Employee Fundings do not have FTE, they prevent prorating the Pay Component by FTE.

|

Simple Pay Components

A Pay Component is considered "Simple" if it does not calculate the Employee Funding Pay Component Factor Amount.

Pay Component Configuration Reference

Employee Pay Components

Item |

Description |

|

|---|---|---|

Name |

Name for the Pay Component |

|

Column Heading |

Label used in the Employee Grid columns. |

|

Description |

Details of the Pay Component purpose and how it is used |

|

Active |

When Active is checked the pay component will be processed during Employee calculations. |

|

Simple Pay Component |

This is a read-only value to indicating that the base Employee Funding Pay Component Factor will be used as is and not be based on any calculation. |

|

Source Type |

Determines where the Employee Pay Component details originate during Employee Reloading from your payroll system. 1.Supplemental - Details are loaded supplemental pay items based on specific search text, Pay Type list or Budget Element String Mask. 2.Deduction - Details are loaded from Employer Paid deductions bases on Deduction Category, Deduction Type, or individual Deduction Id.

|

|

Supplemental Loading |

||

*Payroll Item Text |

|

|

*Budget Element String Mask |

|

|

Deduction Loading |

||

*Deduction Category |

|

|

*Deduction Type |

|

|

*Deduction |

|

|

Qualifier |

||

Employee Column |

A pay component can limited or "Qualified" to specific employees based on an Employee value. Select the Employee value column to use in the qualification |

|

Operator |

Logical comparison to use in the qualification. |

|

Value |

The value to test against. If the Employee Column references a look-up table, you will be able to select a value from that table. |

|

Can Override |

The qualification for this Pay Component can be overridden with the enable check boxes in the Pay Component grid on the Employee Details window. |

|

Factors |

||

Current Factor |

The fixed Factor Amount used in the Current fiscal Year for this Pay Component. |

|

Model Factor |

The Fixed Factor Amount used in this Scenario for this Pay Component. |

|

Employee Column |

Selects an Employee Funding Column to be used in calculating this Pay Component. |

|

Edit Factor |

The Factor Amount is editable in the Pay Component grid on the Employee Details window. |

|

Factor Label |

The label to display in the Pay Component grid on the Employee Details window |

|

Can Override |

Allows the Factor Amount to be overridden by the user. |

|

Data Schedule |

||

Data Schedule |

Select the Data Schedule from the list |

|

Employee Column |

The Employee Value column to use as the look up value for the Data Schedule. This value may be set automatically from the selected Data Schedule. |

|

Result |

||

Pay Type |

There are three primary Pay Types available for Pay Components which control where the calculated amount of a component is included in the Employee Funding: 1.Salary - The calculated amount is included in the Total Salary along with any Annual Rate amount. 2.Supplemental - The calculated amount is included in the Total Pay along with any Total Salary. 3.Benefits - The calculated amount is included in the Total Benefits along with the Benefits amount.

|

|

Budget Element String* Mask |

The Mask used to determine where the Pay Component Amounts will be rolled up into the Financial Budget. When Pay Type is Salary, the mask is not used because the Pay Component is added to the Annual Rate and will follow that Budget Element String. |

|

Value Index |

Read-only Value Index of the Pay Component. |

|

Prorate FTE |

Prorate the Factor Amount across all Employee Fundings based on Total FTE or Enabled FTE. |

|

Prorate Full Amount |

Prorates the full Factor Amount even if Total FTE or Enabled FTE <1 |

|

Preserve Budget Amount |

When a Pay Component roll-up to the financial budget results in a zero amount, you may want ESP to preserve the amount of the Current Budget in the model. This will allow discretionary amounts to be adjusted using Spread Adjustments. |

|

Update Model on Reload |

Check this box to update the Model Factor Amounts and Distribution Percents for this Pay Component on the next Employee Reload. |

|

|

||

Employee Details Pay Components