Employees

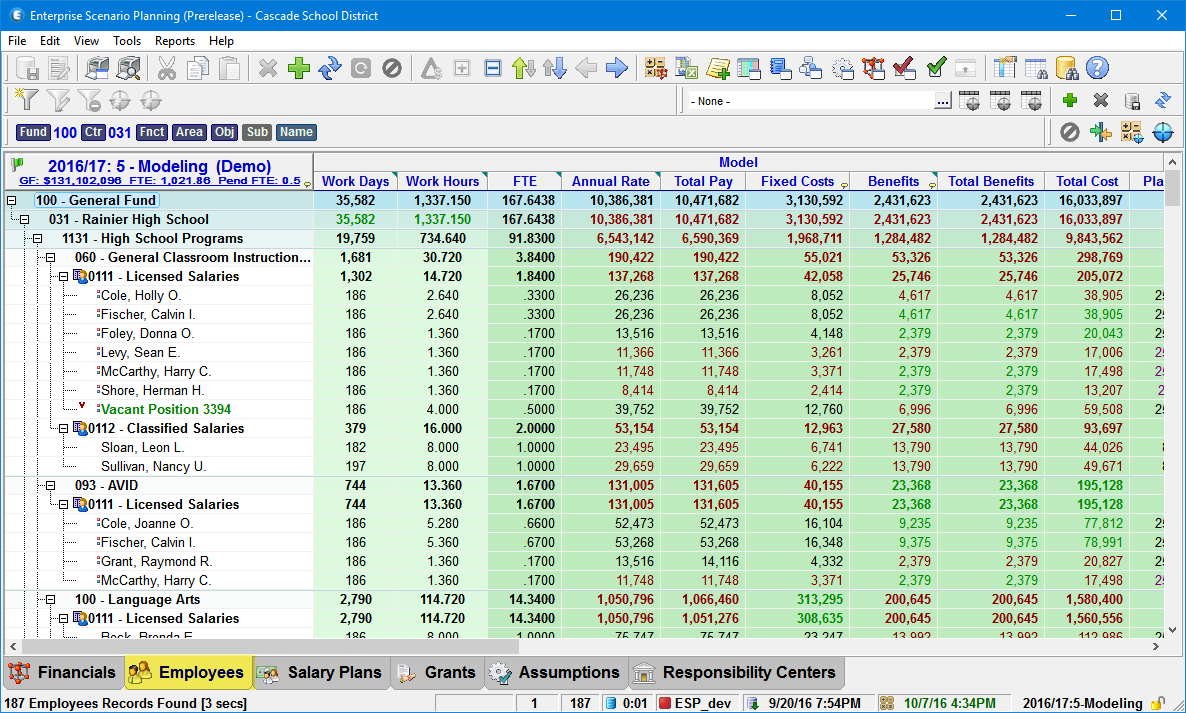

The Employees Grid is the primary place for working with Employee and Position Data. Specific Employee information is displayed based on the current Employee Scope selected. The image below shows the Employees Grid.

The Employee information maintained with each Scenario contains a comprehensive view of the Employees as uploaded from the Human Resources Management System. Because there are many different factors that impact Employee costs to the organization, managing them is a complex process. Modeling Employee records is done independent of the actual Scenario Budget. As adjustments are made to Employees and Salary Plans, the Employees are recalculated with the Recalculate Employees process, and the costs are rolled-up to the Scenario Budget Element String data with the Recalculate Scenario process.

Employee Data

Employee costs generally consume the largest portion of resources available in public sector budgets, this is particularly true for public schools systems. Managing these employee costs is also the most complex area of the budgeting process as there are so many variations and unique situations that must be dealt with. In any payroll system, there are many tables of information used to manage the payment and accounting of employees, and ESP maintains much of that same information, but in more generalized forms. Because ESP is first a modeling tool, it is important that employee data be mapped to standard values and factors whenever possible, minimizing or even eliminating, unique or "one-off" employee situations.

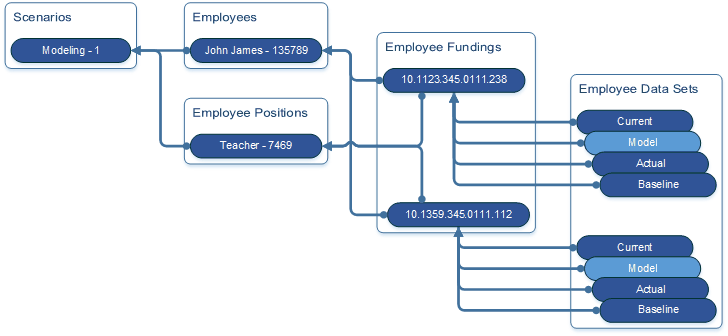

ESP is designed to work with virtually any financial or payroll system so this mapping process is accomplished during employee data loading and reloading by using unique processes designed specifically for the financial and payroll system you are using, as well as configuration settings and factors unique to your own organization. In any payroll system, there are many tables of information used to manage the payment and accounting of Employees, and ESP maintains much of that same information, but in a more generalized form. The primary types of records ESP uses for Employee budgeting and reporting include:

Employee Data Records

Record Type |

Description |

|||

|---|---|---|---|---|

Employee |

Basic information unique to an Employee like:

|

|||

Employee Funding |

The Employee Funding Record defines the association of an Employee Position with a specific person, as well as the cost breakdown for that position. An Employee Position may have the funding source for the person it is associated with come from multiple sources. The Employee Funding record defines the funding source as a Budget Element String (BES) and associated costs and data. Each Employee Funding record is associated with only one Employee record, however an Employee Record may have multiple Funding Records. Each Employee Funding record must reference a single Employee Position record, even of it is a generic default position record maintained in ESP. Employee Funding records contains information like:

|

|||

Employee Data Set |

The Employee Data Set records associated with an Employee Funding record makes up a complete view of the Employee Funding based on the specific Data Set it is associated with. Each Employee Data Set Record is associated with a single Employee Funding record, and each Employee Funding record has multiple system defined Data Set Records. Currently these sets are defined as: 1.HR Current 2.Model 3.Actuals 4.Baseline See Scenario Data Sets for more information. Employee Data Set records contains information like:

|

|||

Employee Position |

The Employee Position record defines a job or duty that is ultimately performed by a person but in a generalized form. The Employee Position record defines the initial or default factors for a position, where each Employee Funding and its Data Sets define the actual position(s) implemented. Each Employee Funding record must reference a single Employee Position record, even of it is a generic default position record maintained in ESP.

Employee Position records contain information very similar to the Employee Data Set:mark

|

|||

1.Unique Primary Key Values Within a particular Scenario, there cannot be duplicate records that have the same values. 2.Budget Element String (BES) See Budget Element String |

||||

Employee Status Flags

Status |

Exclude1 |

Description |

|

|---|---|---|---|

Active |

|

The entire Employee Funding, including all Data Sets are excluded from the Scenario.

|

|

Budgeted |

|

The Employee Funding was created by a user and does not exist in the HR Current Data Set loaded from the payroll system. Budgeted positions are best used for "what if" situations. |

|

Pending |

|

The Employee Funding, Model Data Set is excluded from the Scenario, all other Data Sets remain. Pending status is used to temporarily remove an employee position from its current funding source, but only impacts the Model Data Set. The HR Current, Actual, and Baseline Data Sets are not impacted.

|

|

Segmented |

|

Segmented Employee Fundings are used when an employee fills multiple partial year positions, or when the funding source changes within the Fiscal Year. |

|

Supplemental |

|

The Employee Funding does not include any FTE value and is used to allocate Employee Pay Component amounts to Budget Element Strings which are different from the main Employee Funding. |

|

Temporary |

|

Identifies Employee fundings that are considered temporary, but should be tracked similarly to a regular Employee Funding.

|

|

Vacancy |

|

Vacancies are Employee Fundings which are needed but are not yet associated with an actual Employee. |

|

1.Exclude Model Costs and FTE values are excluded from the Scenario and Totals. |

|||

FTE Calculation

Although the ultimate goal of Budgeting focuses on costs, a primary component in managing staffing and associated costs is the Full Time Equivalency factor, or FTE. In its simplest form, an employee's salary can be calculated by multiplying a salary base amount from a schedule or contract by an FTE factor. This is very simple when an employee is a full time, salaried employee with an FTE of 1, but unfortunately this often is not the case. If you have an employee that is full time and salaried, but has their salary funded from 2 different cost centers, programs or grants, their total FTE may still equal 1, and they still receive their full salary, which is really all the employee cares about, but they may have .375% of their salary provided by one cost center budget and the balance, or .625%, provided by another. Most Budget Analysts know that .375 FTE is the same as 3 work hours in a standard 8 hour work day, and .625 is 5 Works hours, but as funding splits get more complex and often use fractional hours, managing them using Work Time rather than FTE is much simpler and leaves the calculations and necessary rounding to ESP.

|

FTE is used throughout employee budgeting and is almost always calculated from the Work Time of Employee Fundings and Positions. This makes it important that each Employee Funding be able to reference a base Work Time value, either Work Hours or Work Days, or both. If one or both of the Work Time values is missing from the Employee Funding, or if only FTE is provided, ESP will calculate the Work Time values from values ESP knows about using the following progression:

1.Position Funding

2.Employee Position

3.Salary Plan

4.Standard Work Hours/Days

Annualized Salaries

As data is loaded and reloaded from the payroll system, there are many variations in the implementation of Employee Positions which need to be evaluated in order to best report or model the Employee Fundings. When using a Modeling Scenario, it is often necessary to extend or Annualize the Work Days of a partial year Employee Funding so the anticipated costs in the upcoming year are fully realized to a full year, as is the case of a filled Vacancy, but for truly partial year, or Segmented positions, maintaining the position Work Days may also be desired. In the case of SnapShot or Maintenance Scenarios, Work Days are not automatically Annualized.

Contract Year

Contract Year is determined by adding the Salary Plan Work Days to the Salary Plan Contract Date. If the Salary Plan Contract Date is missing or occurs before the Scenario Budget Date, the Scenario Budget Date will be used as the Contract Start.

Calculated Working Days

Calculated Working Days are the available working days which occur between the start and end dates of the Employee Position or Employee Funding, excluding weekends but including holidays. ESP supports excluding additional days by using a Calendar Data Schedule assigned to the Salary Plans.

Work Days Fulfilled

Employee Fundings, Work Days are considered Fulfilled if the Calculated Work Days of the Employee Position are greater than or equal to the Work Days of the Employee Position, and either the Employee Funding Start Date or the Employee Funding falls with the Contract Year.

Annualized Work Days

Based on the conditions loaded from the payroll system, Employee Fundings with Work Days less than those defined by its Employee Position may have the Work Days increased to match the Employee Position, ensuring adequate Costs are modeled for the upcoming Fiscal Year. The process of extending the Work Days to a full year is called Annualization.

Segmented Employee Fundings

Segmented Employee Fundings are used when an employee fills multiple partial year positions, or when the funding source within the Fiscal Year.

Position Type |

Position |

|

|

|

Description |

|---|---|---|---|---|---|

|

Start Date |

End Date |

Work Days Fulfilled |

Annualized |

|

Normal Position |

<= Contract Date |

>= Fiscal Year End |

|

|

|

Segmented Position |

<= Contract Date |

<= Fiscal Year End |

|

|

|

|

> Contract Date |

>= Fiscal Year End |

|

|

|

Replacement |

|

|

|

|

|

Vacancy |

|

|

|

|

|

1. |

Employee ESP System Settings

ESP Setting |

Default |

Description |

FTE Calculation Method |

Work Hours |

Work Hours - FTE Is calculated based only on Work Hours: (Funding Work Hours / Position Work Hours). When calculating Work Time Values from FTE, only Work Hours is prorated by the FTE factor. Work Days is set based on the progression described above. Work Days - FTE is calculated base on Work Days: (Funding Work Days / Position Work Days). When calculating Work Time Values from FTE, only Work Days is prorated by the FTE factor. Work Hours is set based on the progression described above. Work Time - FTE is calculated base on Work Time: (Funding Work Time / Position Work Time). When calculating Work Time Values from FTE, only Work Hours is prorated by the FTE factor. Work Days is set based on the progression described above. |

Standard Work Hours |

8 |

Defines the Standard Work Day in Hours. |

Standard Work Days |

260 |

Defines the Standard Work Year in Days. Equals 52 weeks * 5 Days. |

Employee FTE Rounding |

4 |

Rounds Calculated FTE values to the specified number of decimals |

Financial FTE Rounding |

4 |

When Rolling Up FTE from the Employees to the Financial Budget, Roll-up FTE values are rounded to the specified number of decimals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|